For the last 30 years, Quayside has been pioneering investment in the Bay of Plenty. Our team of specialists work together to create intergenerational return and economic, environmental and social growth.

In 1991 the Bay of Plenty Regional Council took a bold step. They established Quayside Holdings as their investment arm, with a majority share in the Port of Tauranga (PoT). However, Quayside is far more than that today.

Our unique position, structure and innovative team of experts has allowed us to become one of New Zealand’s most successful investment companies, right here, in your backyard.

In our 30 years of operation, we have used our commercial focus for the good of the region and created wealth for regional ratepayers that goes beyond all expectations.

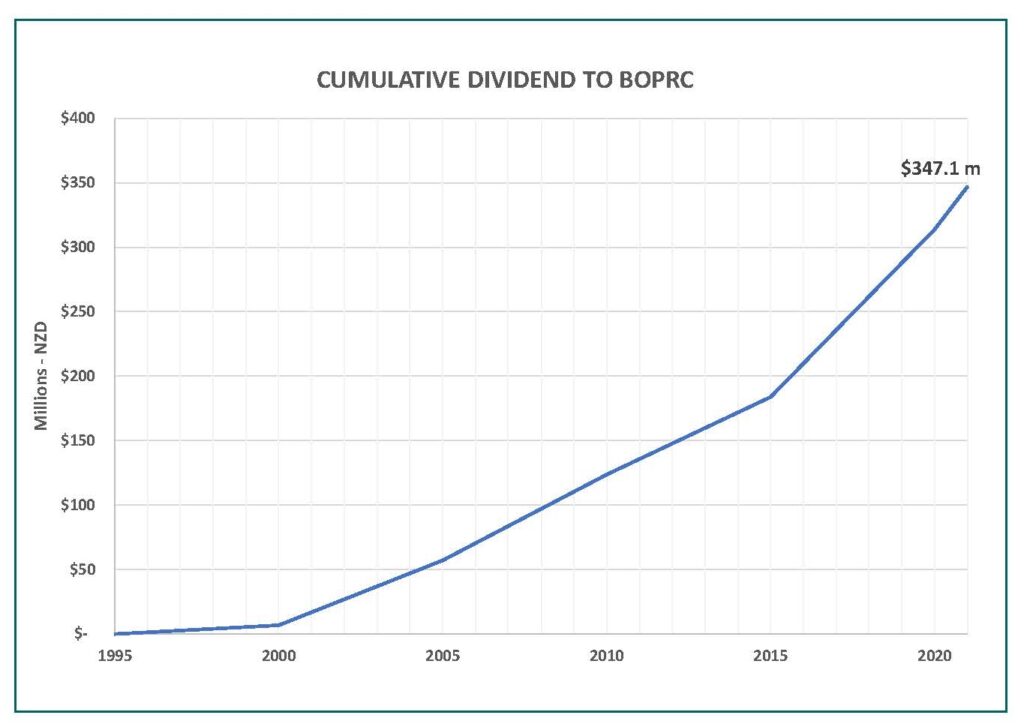

In 2021, our dividend back to the Regional Council was $33 million – this is proposed to grow to $40 million in 2022. The graph below shows the 2021 cumulative dividend, helping the community to the tune of $347.1 million.

Quayside has created a staggering $600 million worth of value for regional ratepayers with the inclusion of a $200 million Regional Infrastructure Fund through the issuance of Perpetual Preference Shares (PPS) and the initial payment to Regional Council to acquire the Port stake.

As a publicly owned entity, we take our responsibility to the region seriously. We consider investment opportunities from all angles – including environmental, social and governance (ESG) and how it contributes to a brighter future for the Bay.

Here are some of Quayside’s investments:

Port of Tauranga growth and prosperity. Our share value has grown from $53 million in 1991 to $2.6 billion in 2021. The Port of Tauranga is the region’s largest economic driver and the largest container and bulk export port in the country.

Diversified investment outside of the Port worth $400 million, across private equities, managed securities, local and regional commercial development, joint ventures and innovative investments consistent with our ESG commitments and focused on intergenerational growth. Our diversified portfolio means Quayside can still provide the Regional Council with distributions if the Port should experience a less than successful year.

Our $40 million partnership with Huakiwi in 2017 is a success we are all proud of. Transformation of underutilised Māori-owned land into profitable kiwifruit orchards that provide employment, opportunities and strong financial return.

Our $40 million partnership with Huakiwi in 2017 is a success we are all proud of. Transformation of underutilised Māori-owned land into profitable kiwifruit orchards that provide employment, opportunities and strong financial return.

Our journey with Te Tumu Paeroa has only just begun – full ownership of the orchards is targeted to transfer back to tangata whenua within a generation.

Quayside’s successful investment into Ōpōtiki Packing and Cool Storage Ltd (OPAC) in 2015 meant OPAC’s expansion became a sub-regional success, creating an engaged, vibrant community partner as the largest employer in Ōpōtiki and doubling its capacity within three years.

With Seeka’s acquisition of OPAC in 2021, Quayside has demonstrated providing a positive financial return as well as creating broader economic benefits for the region.

Our focus is long-term and intergenerational – but what does that mean for you?

Through our investments we will still be providing returns and creating wealth for our community when your grandchildren and their grandchildren are enjoying all that the Bay of Plenty has to offer.

Through investment that’s deeper than profits, we provide a brighter future

for Bay of Plenty. Our best stories are ahead of us. Stories your future generations will be part of.

Learn more about Quayside at our website www.quaysideholdings.co.nz

Key Facts on Quayside

- Quayside is a Council Controlled Organisation under the Bay of Plenty Regional Council.

- Quayside was established in 1991.

- Quayside’s assets have grown from $53m in 1991 to $3.1b in 2021.

- Diversified, innovative and strong portfolio supporting the region’s economic, social and environmental wellbeing.

- In 2021, we returned $33m to the Regional Council to invest into our community. In 2022, this is projected to be $40m.Without Quayside’s investments, general rates would have to at least double for the Regional Council to serve the community in the same way.

Timeline

1991 Quayside established as commercial investment arm of the Bay of Plenty Regional Council, borrowing $53m to acquire Port of Tauranga (POTL) shares from the Council.

1998 Regional Council receives its first dividend ($1.29m) from Quayside.

2008 Regional Council raises $200m through a Perpetual Preference Share issue in Quayside. These funds are deployed into assets such as the University of Waikato campus in Tauranga.

2013 Quayside’s assets exceed $1 billion.

2014 Quayside is the founding shareholder in WNT Ventures (Tauranga-based tech incubator).

2016 Quayside becomes the cornerstone founder investor in Oriens Capital.

2017 Quayside and Te Tumu Paeroa create a joint venture, Huakiwi Services Ltd, investing in kiwifruit orchards on local iwi freehold land.

2020 Quayside assets for the community exceed $3 billion. Government funding grant is received to advance The Business Park at Rangiuru for the benefit of the wider community.

2021 Quayside celebrates 30 years of creating value for the Bay of Plenty Regional Council ratepayer.

07 579 5925

www.quaysideholdings.co.nz