Never has it been more important to make sure your insurance cover reflects what it will cost to replace assets and rebuild your business back should you need to

do so.

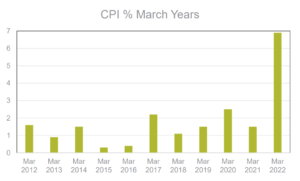

General inflation

Annual inflation figures released 21 April 2022 show that Consumer Price Index inflation in New Zealand is 6.9% for the year ended 31 March 2022. Crombie Lockwood says it’s experiencing a steep increase in the cost of repairing and replacing assets across all sectors and industries including residential housing.

This, however, doesn’t reflect the full picture for many businesses where commodity prices have risen more than the Consumer Price Index. For example the WTI crude oil price has increased 68% in the 12 months to 21 April 2022 and as a core commodity, the rising cost of oil is seeing increases in the cost of plastics and chemicals, petrol and freight.

Businesses need to speak to their insurer to review and increase sums insured and associated sub limits to meet the rise in costs.

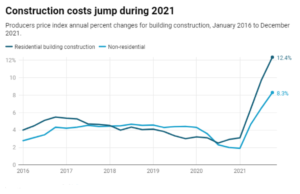

Construction cost increases

The graph below shows the annual increase in average construction costs of residential and commercial buildings.

You risk being underinsured if you do not account for higher re-build costs. Crombie Lockwood’s general advice for commercial building businesses is to get a professional valuation every

12 months to make sure buildings remain correctly insured at the right levels.

Shipping cost increases

|

US$ (Shanghai to NZ) |

Pre Covid |

Now |

|

20ft Container |

$450-$650 |

$4,000-$5,500 |

|

40ft Container |

$1,000-$1,200 |

$8,000-$11,000 |

The cost to ship items to New Zealand has increased phenomenally which is also driving up prices. High shipping costs impacts the cost to land imported items, be it inventories, plant and equipment or vehicles.

Insurance cover of stock levels need to reflect not only the increased cost of the goods due to inflation but also the now large increase in freight costs to get the goods in from overseas.

Delays, delays, delays

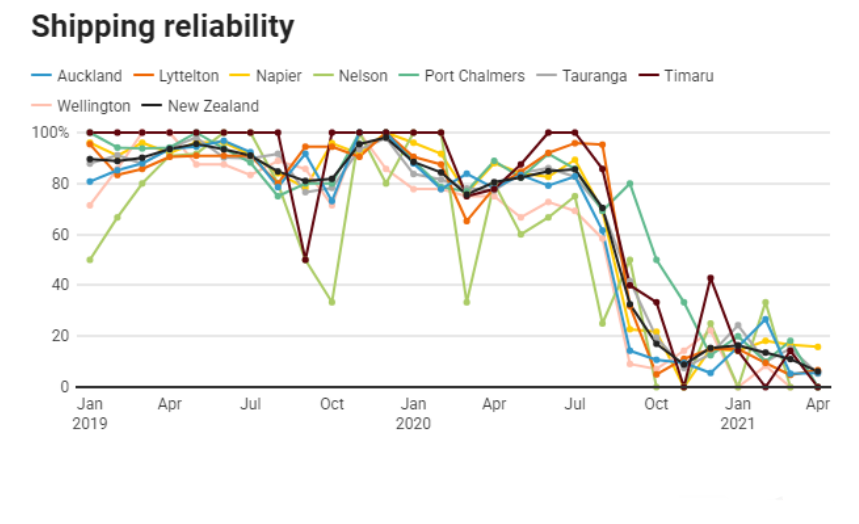

As consumers we have all felt the impacts of growing delays in purchasing and receiving items due to major shipping delays.

The graph below shows pre-Covid most ships coming to New Zealand ports arrived on time, now 80% are late.

Building projects are significantly delayed or simply put on hold because of unavailability of key materials. Suppliers are no longer accepting forward orders for GIB plasterboard but are moving to an ‘allocation basis’.

From an insurance perspective, long time delays are now expected when rebuilding or replacing assets causing disruption to businesses. It is important to talk to your insurer about the need for Business Interruption insurance if you don’t have it in place, or extending your cover term from 12 months to a more relevant 18 or 24 months to counteract delays in the global supply chain.

Similarly review the loss of use for vehicles, indemnity periods for machinery breakdown and your increased cost of working to make sure your business is accurately covered in the event of a claim.

Cost and availability of credit

The Reserve Bank has increased the Official Cash Rate from a low of 0.25% to the current 1.5% on 13 April 2022, with a forecast to increase to 3.4% by the end of 2023 (Source: Table 6.1 02/2022 Monetary Policy Statement RBNZ).

In response, business lending rates are increasing and this, coupled with a tightening of bank lending as a result of the change in lending rules, does not bode well for businesses needing to increase lending limits due to increased working capital requirements resulting from inflation. Businesses need to consider how to maintain cash flow in this complex environment.

To keep your business adequately covered and not reduce cover to reduce cost, speak to your broker.

Your insurance sorted