From first-time investors through to seasoned professionals, it’s difficult to know what investment types are the best fit for your goals. With interest rates rising, many investors are leaning towards term deposits – but are they really the best choice?

We’ve compared three different investment types across the risk spectrum, to help you determine what might work best for you.

Term deposits

Term deposits are familiar to many and easy to understand and obtain, making them a common investment choice. Their attractiveness is only improving as interest rates rise.

However, their lack of liquidity is a significant drawback, meaning an investor’s capital is tied up until the deposit matures, or they may face a penalty for early redemption.

Investors should also be aware of the impact of inflation on the purchasing power of their term deposits over time, especially when the rate of inflation is higher than the interest rate they are receiving on the term deposit.

Fixed-interest securities

Similar to term deposits, fixed-interest securities (also known as bonds) offer an opportunity to earn interest through coupon payments. Unlike term deposits, they are tradable, allowing investors to sell them for cash when needed.

Tradability gives investors greater flexibility and allows them to respond to changes in their financial circumstances or market conditions.

As tradable assets, bond prices do fluctuate when market interest rates move up or down. This can then lead to capital gains or losses for the investor if sold before maturity.

Market-driven price changes introduce both an element of risk and the potential for greater returns.

The coupon rate for each bond is determined by several factors, including the issuer’s credit rating, the time to maturity, and the prevailing interest rates.

A balanced portfolio

A balanced portfolio, which is a mix of cash and bonds (income assets) and equities (growth assets) is another option to consider. Some investors may be uncomfortable with the risk associated with equities. However, by incorporating a mix of income and growth assets, a balanced portfolio offers investors the opportunity to access greater returns through equity exposure, whilst mitigating some of the risk associated with those assets through diversification.

A balanced portfolio is suitable for an investor who has an investment timeframe of more than five years.

In the event of an unforeseen change to an investor’s financial situation, the assets can be sold at market prices.

So, what’s the best strategy?

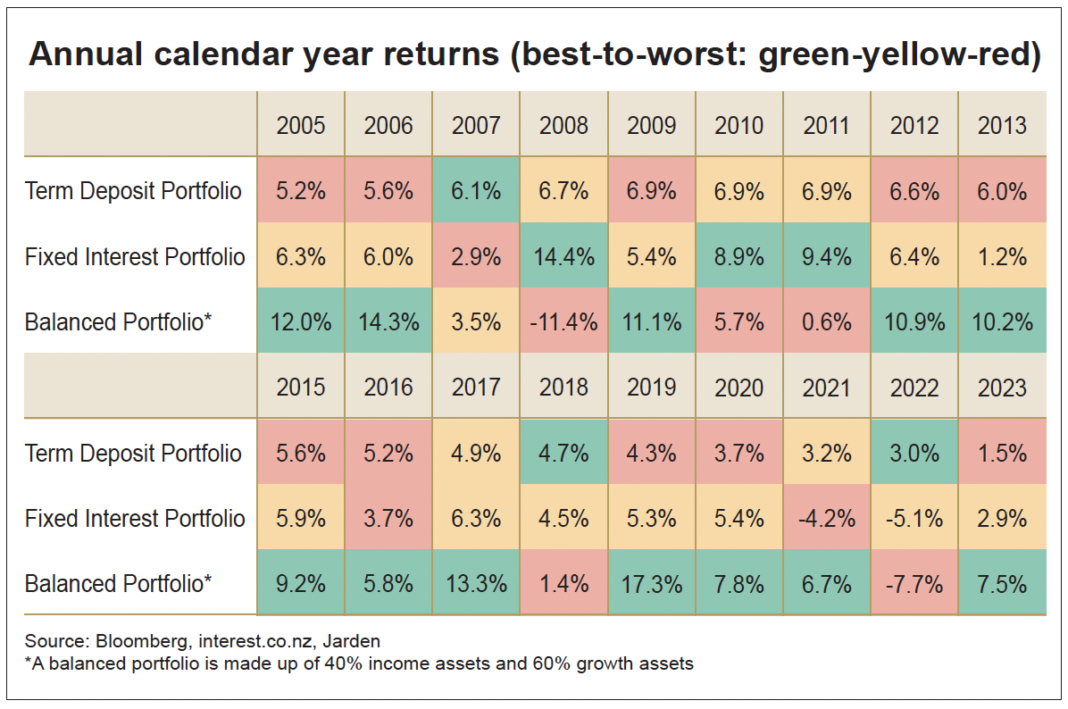

The table above provides a year-by-year performance comparison of a term deposit portfolio, a fixed interest security portfolio, and a representative balanced portfolio (40% income/ 60% growth), from 2005 to 2023. Over this time, the balanced portfolio outperformed the other options 12 out of 18 times. The term deposit portfolio and the fixed interest security portfolio were the top performer three times each.

These figures illustrate the steady, yet more modest returns generated by the term deposit portfolio and the stronger but more volatile returns of the balanced portfolio. This comparison underscores the risk-return trade-off – while increased potential returns can be accompanied by increased volatility, a balanced approach can help manage this dynamic.

Every investor will be seeking a different outcome from their investments, it all comes down to your personal investment goals and tolerance to risk. Whilst rising interest rates typically make term deposits a safe investment choice, investors looking for greater returns over the longer term shouldn’t overlook the potential benefits of a balanced investment portfolio.

Please contact your local Jarden Adviser if you would like advice on what strategy would be the best to help you achieve your goals. You can reach our Tauranga team on +64 7 834 2727.

Disclaimer: The information and commentary in this article are provided for general information purposes only. It reflects views and research available at the time of publication, using external sources, systems and other data and information we believe to be accurate, complete and reliable at the time of preparation. We make no representation or warranty as to the accuracy, correctness and completeness of that information, and will not be liable or responsible for any error or omission. It is not to be relied upon as a basis for making any investment decision. Please seek specific investment advice before making any investment decision or taking any action. Jarden Securities Limited is an NZX Firm. A financial advice provider disclosure statement is available free of charge at https://www.jarden.co.nz/our-services/wealth-management/financial-advice-provider-disclosure-statement