Life can be uncertain and sometimes things can go wrong. Having an emergency fund is one of the most essential financial practices you can adopt.

What exactly is an emergency fund?

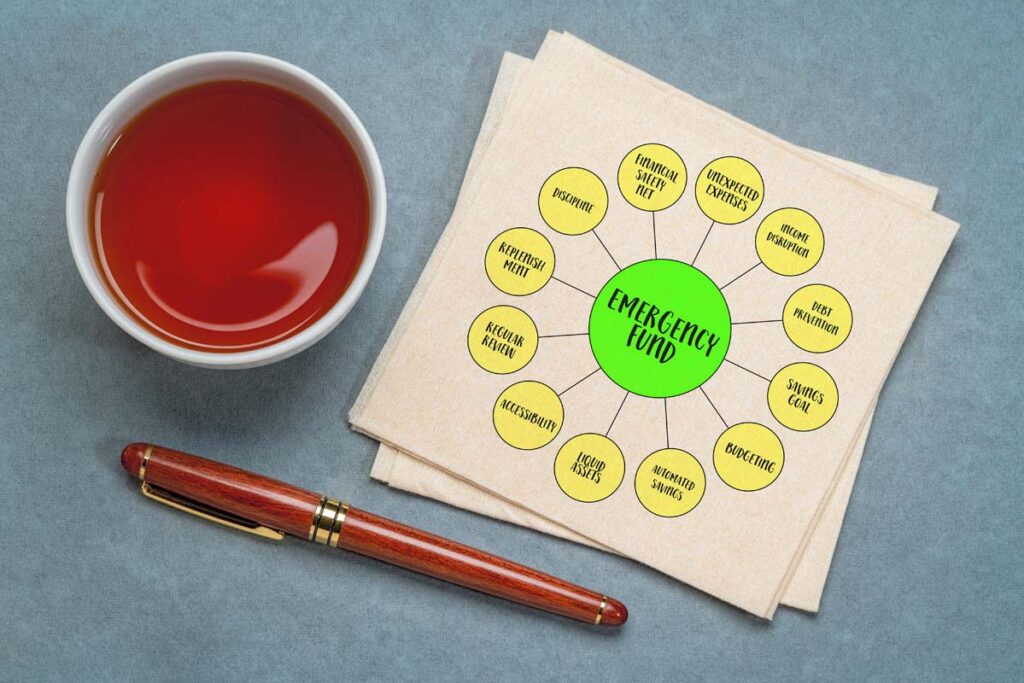

It is an amount of cash that you know you have relatively quick and easy access to when you need it. An emergency fund can help you prevent debt or tapping into your savings when you face a sudden and unexpected financial challenge, giving you the confidence of a security net for stressful moments that you may face in life.

By having an emergency fund, you don’t have to rely on credit cards, loans, or other forms of borrowing to cover unexpected expenses, avoiding the risk of falling into a debt trap.

This isn’t to be confused with a rainy-day fund, an emergency fund is not a luxury, but – ideally – a necessity. A rainy day fund is for impulse purchases, spur of the moment getaways, or helping friends or relatives in need. On the other hand, an emergency fund is for safeguarding your financial stability and well-being in times of crisis.

Instead of cash is king, think cash management is king. An adviser can create strategies for your cash management ensuring you do the best that you can. You might be pleasantly surprised by what options are out there for you such as high yield savings accounts and Cash PIE funds. The money is not helpful to you if you can’t access it in a time of emergency, so these are not funds to invest in long term fixed products or growth assets.

Why?

Some emergencies that people may face include medical emergencies, sickness or harm, losing income, or sudden geographical events that create financial difficulties. While you might have insurance for some of this, it may not be adequate to fully replace what you have lost.

You can also use your emergency fund as a buffer for your budget in times of hardship and adjust your spending and saving habits accordingly. This can help you stay on track with your financial goals, such as buying a home, paying off debt, or retiring early.

How much do you need in your emergency fund?

An easy way to estimate how much should be in your fund is to ask yourself how much would you need to get by for three to six months if you were suddenly unable to earn your income? Three to six months’ worth of expenses is a common rule of thumb, but it can be different for everyone. Setting up a fund with any amount is a step in the right direction.

Who needs one?

Everyone! If you don’t have one, and you’re able to, you should make it a priority to start building one. Peace of mind alone is reason enough to start building.

Having an emergency fund is the first step to strong financial wellbeing.

Once in place you can start to think about short term and even longer-term goals. You will have peace of mind that you can start to consider volatility and creating growth because you will know that you will have funds to fall back on.

If you want to build a solid financial foundation, start by setting up an emergency fund today.

Working out a budget, settling on a realistic amount, committing to regularly transferring surplus, and removing visibility of the account from internet banking so you’re not tempted to touch it. This will give you the security and confidence to face any challenge that life throws at you.

This research has been prepared by Jarden Wealth Limited (Jarden) which holds a licence issued by the Financial Markets Authority to provide a financial advice service. The information in this research solely relates to the companies and investment opportunities specified within. The nature and scope of any financial advice included within that research is limited to generic and non-personalised commentary about that investment only, such as the performance and the investment outlook of the company concerned. Any such commentary does not take into account any individual’s particular financial situation, objectives, goals or appetite for risk. We recommend that you seek financial advice that is specific to your personal circumstances before making any investment decision or taking any action. No fees, expenses, or other amounts will be payable for the provision of any financial advice in this research report. However, if you act on any information or advice contained in this research report, a brokerage fee (and other fees such as an administration and custody fee) may be payable to Jarden. For fees payable for brokerage and other services provided by Jarden, information on our complaints and dispute resolution process, and the duties applicable to us for providing financial advice, please see our publicly available disclosure statement, https://www.jarden.co.nz/our-services/wealth-management/financial-advice-provider-disclosure-statement/.