In last month’s Fringe Benefit Tax (FBT) article, we shared top tips for reducing your fourth quarter FBT liability. Since then, there have been developments in relation to both the FBT policy review and Inland Revenue’s view on vouchers and gift cards. These will be important to keep in mind for the current FBT year and if you are planning any changes in how you provide benefits to employees.

FBT policy review

The review proposes some fairly significant changes to how vehicles and unclassified benefits could be taxed in future. The goal is to establish rules embracing a ‘close enough is good enough’ approach to give a better approximation of a benefit’s remuneration value and reduce compliance costs for employers.

Vehicles

One of the key proposed changes is to increase the standard calculation of taxable value, the amount on which FBT is paid, from the current 20 per cent per annum to 26% per annum for petrol and diesel vehicles. Slightly lesser rates would apply for electric and hybrid vehicles.

This increase in the base taxable value represents the increased cost of operating vehicles since the calculation was last reviewed. It is also proposed that the ability to use tax book value, instead of cost price, could be removed.

The other significant proposed change is to take a ‘remuneration approach’ to how much FBT should be paid on any vehicle based on the limitations placed on an employee’s use of the vehicle.

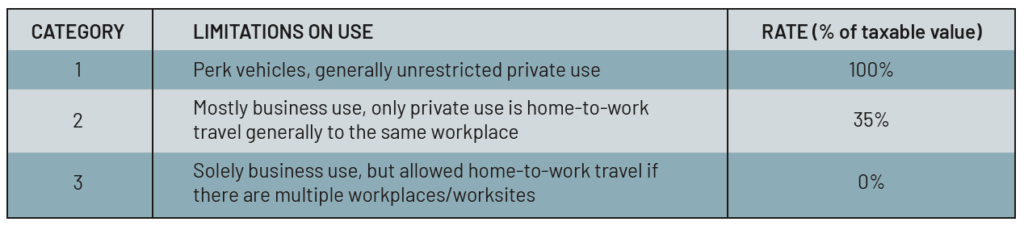

The following three categories are currently proposed with FBT payable on the appropriate portion of the taxable value of the vehicle:

This change could have a significant effect on the amount of FBT liability for employers with large fleets of vehicles.

Unclassified benefits

The unclassified benefits category was created to cover all non-cash benefits, often small value items without real remuneration value. The review proposes two options to refocus FBT on genuine remunerative benefits:

- Remuneration test: this would exempt most benefits that cost less than $200 each, provided they are not substituting for remuneration

- List of non-remunerative benefits: this would define excluded benefits, such as flowers, one off prizes under $200 and token gifts.

Entertainment

Currently, businesses can (typically) only claim a 50% deduction for work related entertainment expenses in their annual tax return. The proposal suggests moving entertainment, including client entertainment, into FBT with a new category taxed at 49.25%, simplifying record keeping for businesses.

Vouchers/gift cards

Separate from the review on FBT, Inland Revenue has finalised its position on ‘open loop cards’, which are vouchers and gift cards that can be used at most merchants.

Inland Revenue has confirmed that, as these vouchers are close enough to money, they should be treated as such and taxed under the PAYE system not FBT. This approach is inconsistent with how most businesses have been taxing these benefits.

The treatment of ‘closed loop cards’ (vouchers that can only be used at select merchants) will still fall under FBT rules. From April 1, Inland Revenue has been expecting all businesses to apply this treatment and pay PAYE where appropriate.

The draft legislation for the FBT changes is expected in August, so keep an eye out for future articles which will cover this. In the meantime, for more information or further guidance about how the FBT review and gift card changes could impact your business, consult your tax advisor.

RELATED: Saving tips for FBT bill