National’s tax threshold changes were confirmed as part of the Budget 2024, albeit with a delay in the effective date to 31 July to allow software providers time to update their systems.

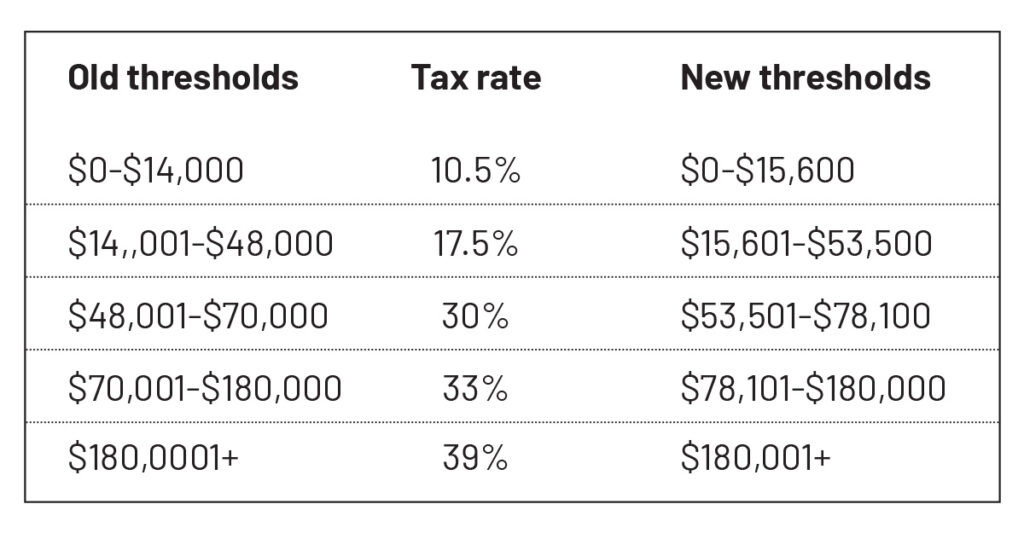

The tax rates themselves remain the same, but the income thresholds for all but the top bracket have been increased. This means the effective tax rate for all earners will decrease, i.e. the same amount of income will be taxed at a lower rate. See chart.

For pay days on or after 31 July 2024, less PAYE will be deducted from an employee’s pay, meaning more cash in hand. Exactly how much more cash in hand someone will get will depend on how much they earn in the pay period and whether they qualify for other financial support measures.

Because we have two sets of thresholds applying for part of the year each, there needs to be a set of what is called “composite” rates that apply when 2025 year tax returns are filed. These composite rates effectively average the tax reduction across the whole year when working tax on annual income. If someone earned proportionately more income in the period after 31 July 2024, they may have been undertaxed via PAYE deductions and have a tax liability when their return is completed, and vice versa. This could affect individuals who are entering or leaving the workforce during the year, or others who work on a casual basis for periods of the year only.

Consequential changes

Tax threshold changes don’t impact only on payroll, tax code selection, and personal tax calculations, they also have flow-on implications for other tax types. Given the short lead time, the Government has taken a variety of approaches to when these different taxes will change:

- Thresholds used for extra pays, ESCT, RSCT, PIR rates – Only change from 1 April 2025

- Thresholds for FBT – Only change from 1 April 2025, but a new formula for calculating the alternate rate liability applies for the 2025 year. If excel spreadsheets are used to calculate FBT in the March quarter, changes will be required for 2025 and 2026 years

- RWT rates – If an individual has moved down a tax threshold as a result of the band changes they can elect a lower RWT rate by notifying your interest payer.

Independent earner tax credit (IETC) – the upper threshold for eligibility for the IETC has been extended to $70,000 meaning an anticipated extra 420,000 taxpayers will be eligible. These changes should be built into the new PAYE table calculations and therefore shouldn’t require further work from employers.

FamilyBoost – Not technically a tax change, but administered by Inland Revenue, is “FamilyBoost” which provides a credit for a portion of childcare costs for eligible families. FamilyBoost will be available from 1 July 2024, with parents required to upload invoices to Inland Revenue on a quarterly basis for payment of the credit. Employers are not responsible for FamilyBoost, but may field questions if employees don’t understand how this “tax relief” will be delivered.

Conclusion

We understand that payroll providers were made aware of the impending changes ahead of the Budget, and as such have had a head start to get software updated. We recommend that employers touch base with their payroll provider (if this is outsourced) to find out the timelines for software updates and testing. Employers who prepare their own payroll may wish to consider whether now is a good time to move to an outsource model, or otherwise should keep an eye on the Inland Revenue website for key updates to PAYE deduction tables.

Related: Tax changes taking effect this month