If there is one topic guaranteed to get our readers’ attention in Deloitte Tax Alert articles, it is how to get the tax treatment of paying for employee travel costs correct.

Most employers will reimburse employees for occasional work-related mileage. If you are using IR rates as the basis for your reimbursement to employees, you can rest assured that the amounts can be paid tax free.

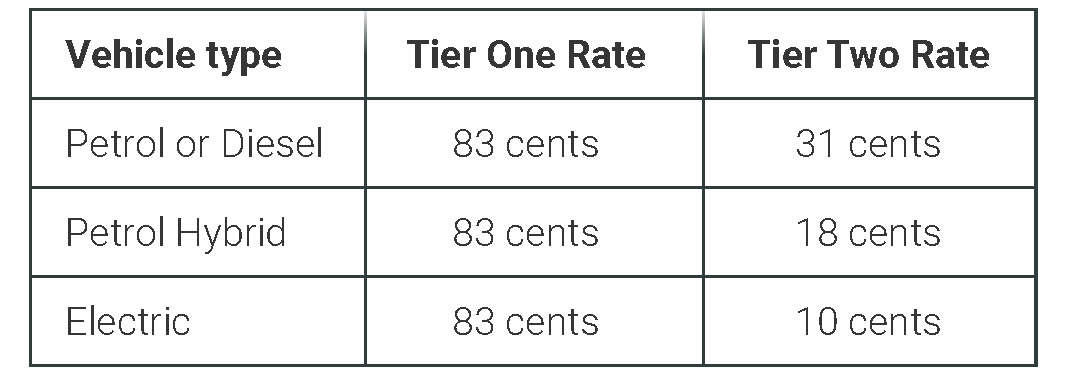

Just be aware that IR updates its rates annually – the current base (or Tier One) rate was increased to 83c per km from 27 May 2022.

With ever-increasing petrol costs it is hard to imagine at the moment that the IR rate would decrease, but it has done so in the past and this can catch employers out leaving them exposed to PAYE on what then become excess reimbursements.

Another thing you need to watch out for is where any employee is reimbursed for more than 3,500km in a year.

When this level is exceeded, the amount you can pay tax free usually decreases significantly to the Tier Two rates.

If you keep reimbursing beyond 3,500 km at a higher rate 83c rate, a part of that will be taxable.

You then need to work out, based on your employment agreements or mileage policy, whether you can deduct the PAYE from the reimbursement or whether you need to gross up the amount so that the employee gets the full agreed amount in the hand.

Add KiwiSaver and student loan repayments into the equation and this requires some serious mental gymnastics to work this out.

Of course, you do not have to use the IR mileage rates – you can use other published rates, such as AA ones, or you can base your reimbursement on the actual costs incurred by your employees. These can allow a higher tax-free reimbursement provided you have the data to support the payments made.

If you pay a regular travel allowance to any employees and want to treat all or some of it as non-taxable, you need to make sure you have good records to evidence that the amount paid does not exceed the cost the employees have incurred in their work-related travel.

Ideally you need the employees to keep a logbook of the distances travelled for at least a 3-month period, and then work out the estimated cost of that work-related travel either by applying the IR/AA rates or the actual employee costs.

If the calculation of costs is more than the allowance you pay you’re all good, but if it is less then part of the allowance will be taxable.

I can’t stress enough the importance of making sure you have records to support the amounts you pay if you treat them as tax free.

If IR considers any of the amounts paid are taxable, and tax has not been paid, the cost of the PAYE and other deductions you will get a bill for can be up to 60% of the original reimbursement and you are unlikely to be able to recover this from your employees.

If you want to check how your mileage reimbursement policies stack up, reach out to your accountant or tax adviser.