Tower has invested in detailed modelling showing the risk of flooding from rivers and rain for residential addresses across New Zealand. As of today, Tower is sharing flood risk ratings with all New Zealanders and using its data to better match flood premiums to risk.

Developed with analysis from Risk Management Solutions (RMS), the world’s leading catastrophe risk solutions company, and other data sources, the launch of the model is a first for New Zealand and is part of Tower’s commitment to giving customers a better understanding of their risk profiles.

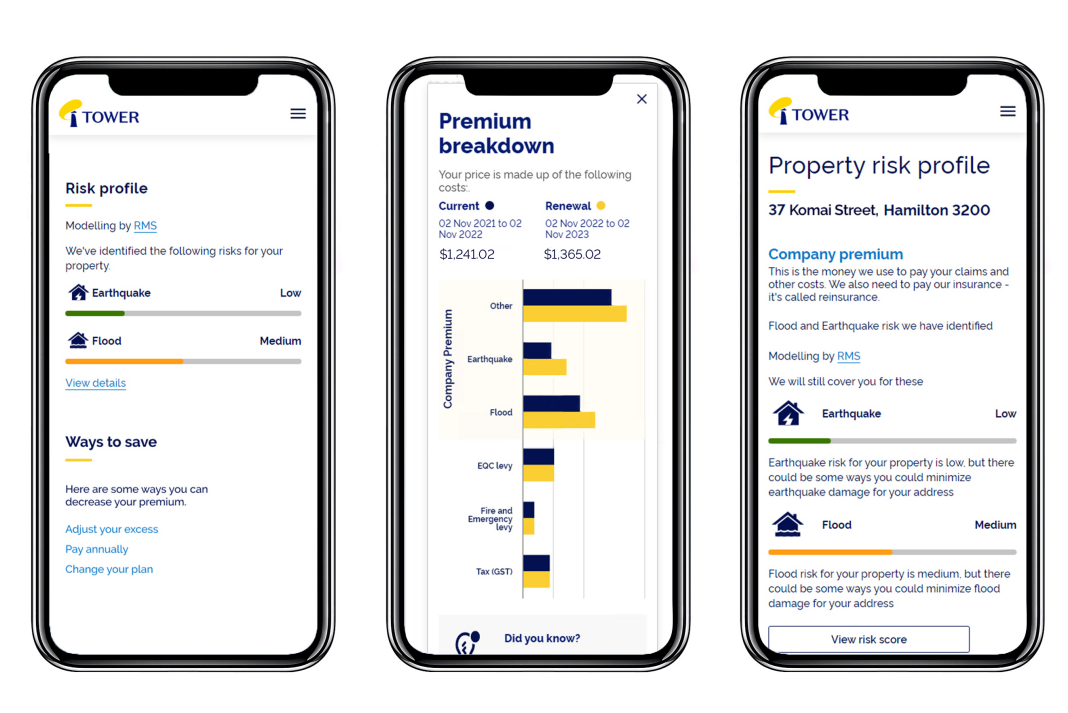

It means Tower customers will receive a low, medium, or high rating for their home, reflecting the potential risk of a flood and the estimated cost of replacing or repairing damage caused by flooding.

For nearly 90 percent of customers, this change means they’ll receive a reduction in the flood risk portion of their premium, at an average of about $25 each. About 10 percent of customers will experience an increase in this portion of their premiums, with the majority of these being less than $50 a year.

Tower CEO, Blair Turnbull says that right now it isn’t easy for homeowners to understand the wider risk and perils linked to their home, including flood and earthquake, and Tower wants to help change that.

“Ninety percent of Kiwis told us that access to flood risk data about a house they are looking to buy may change their thinking about the property in some way.

“We also know that only one in three Kiwis feel very confident that they have the right level of insurance for their current house to cover the risk of flooding by waterways and rainfall. We want to share this information with customers about their properties so they can make informed decisions, and understand their insurance needs and premiums better,” says Turnbull.

In addition to fire and earthquake levies collected on behalf of the government, insurance premiums are made up of many parts such as insuring for damage from fire, general accidents, burglary and weather events. Each of these parts is apportioned based on what insurers know about a customer’s property and risk.

For the flood risk portion of policies Tower will now be able to assign a rating specific to residential addresses, allowing Tower to match premiums more accurately to risk.

According to Lloyds of London Insurance Risk Index Report, New Zealand is the second riskiest country in the world after Bangladesh when it comes to natural disasters.

“As a Kiwi insurer, we are acutely aware of the climate risks faced by New Zealand. The launch of this model is aligned with Tower’s commitment to a sustainable future and being more open and transparent around insurance and risks associated with climate change.

“Helping customers better understand the breakdown of their insurance premium is important. We believe that risk-based pricing is a fairer way to structure insurance to ensure that customers don’t pay for risks they don’t have.

“This is a pricing model that we’ve seen implemented effectively overseas in countries such as the UK and is a model that people are well accustomed to with other assets such as motor insurance.

The RMS model is built with data obtained from local organisations and institutions, including the National Institute of Water and Atmospheric Research (NIWA), Land Information New Zealand (LINZ), local and regional councils and the ICNZ.

“The benefit of using the RMS model is that it is so detailed that neighbouring properties can have very different ratings, depending on the camber of their land, whether they have a flood wall, and other factors.

“It means we can predict the impact on the individual property based on how it is constructed, height, number of floors, materials, and flow of the water,” says Mr Turnbull.

RMS Managing Director for Asia and Europe, Vivek Bajaj, says the local partnerships allow RMS to gather best-available local market intelligence.

“The latest RMS New Zealand Inland Flood HD Model is the world’s first fully probabilistic flood model for the country. The model uses RMS analysis based on 50,000 years of continuous simulation of the entire precipitation cycle and all sources of flood – pluvial and fluvial – resulting in a catalogue of 350,000 simulated events. The flood model also includes all publicly available flood defence and mitigation efforts.

“We are pleased to support Tower’s goal of transparency and clarity,” says Mr Bajaj.

Anyone wanting to use the new tool to understand their risk profile better can request a quote from Tower or log into their My Tower portal. This shows people their property’s individual results for flood insurance risks, as well as see a breakdown of other pricing elements.

For existing customers, any changes to pricing will commence at their next renewal date.