Chartered Accountants Australia and New Zealand (CA ANZ) is pleased to see the Government welcoming a recommendation from the Finance and Expenditure Select Committee that it pulls back from implementing a blanket 39 per cent trust tax rate, saying it recognises that trusts are created for a variety of reasons and not just to avoid paying the top tax rate.

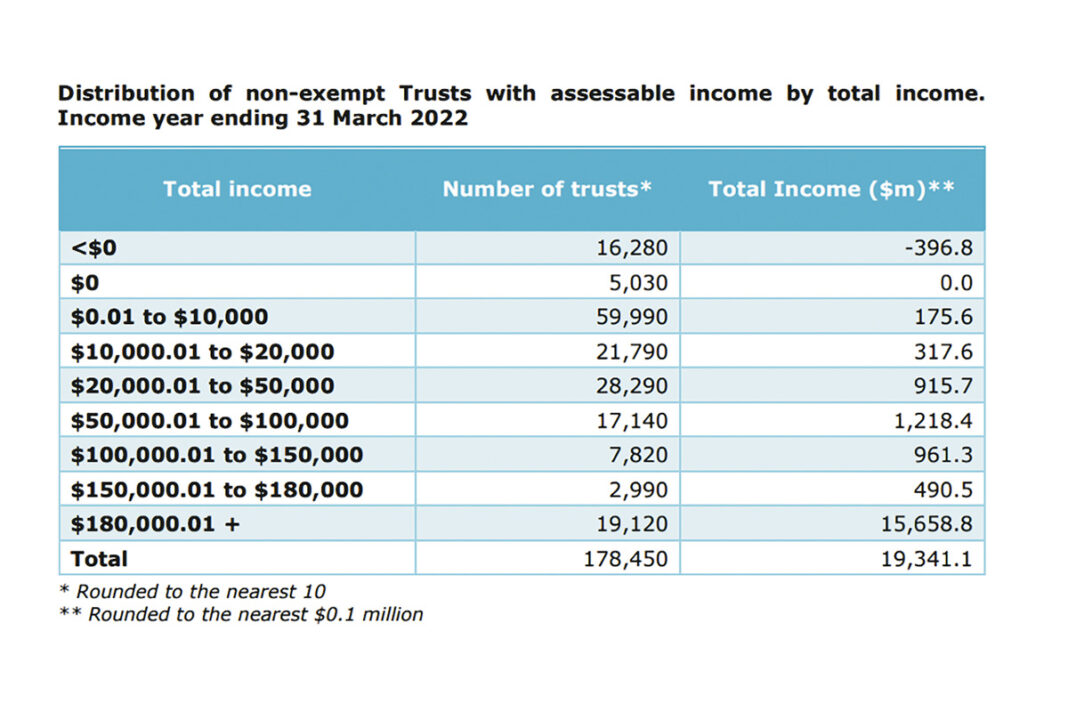

A proposal to tax all trusts at a 39 per cent rate from 1 April 2024 would have significantly over-taxed most New Zealand trusts, with the Government’s own data showing that nearly half (46 per cent) had income of less than $10,000, said John Cuthbertson FCA, CA ANZ’s New Zealand Tax and Financial Services Leader.

“Low-income trusts, often set up to protect assets, give to charity and provide for the welfare of beneficiaries, would have faced a leap in their taxation rate to 39 per cent. The current trustee rate of 33 percent already leads to an element of over taxation for many trusts.”

The Finance and Expenditure Committee today recommended a two-tier tax rate structure for trusts, based on CA ANZ’s own proposal, but with a much lower ‘de minimis,’ of $10,000, where trusts with income over that figure would be taxed at 39%.

“The recommendation is great news for trusts which generate relatively small amounts of income and were set up for a variety of reasons other than avoiding tax,” Cuthbertson said.

“CA ANZ proposed a de minimis of $100,000, to provide fairer taxation to more trusts, but overall we’re pleased that the committee has listened to all the submitters who supported the concept of a two-tier regime.”

“A $50,000 de minimis would have covered 74 per cent of trusts and would better “right-size” the alignment of tax rates – but the current $10,000 level will at least prevent over-taxation of 45 per cent of trusts.”

Inland Revenue data shows the contrast between the number of trusts and the income they generate.

In the year ending 31 March 2022, 89 per cent of trusts had taxable income significantly below $180,000 which is the 39 per cent tax rate income threshold for personal income tax.

At the same time, the top 11 per cent of trusts earned 81 percent of total trust income ($15.7 billion) before allocation.

Related: New rate will overtax 89% of trusts