Property Brokers’ regional manager for the Bay of Plenty and South Waikato, Simon Short, believes this is very much a time for investors to look to property for wealth building.

“The market is showing positive signs of rebound and there will be an increase in that activity as the year progresses,” he predicts. “Our markets are always influenced by simple economics, supply and demand; with the availability of funding and increased lending appetite expected to rise as 2025 draws closer we believe there will be a momentum shift toward real estate investment in all sectors.”

Simon suggested we talk to his team to get a sense of the market from his specialists on the ground. We spoke to three of his team members who specialise in commercial, industrial, agriculture and horticulture property investment.

Rich Graham

Sales consultant Rich Graham says commercial real estate (CRE) can be a very lucrative investment offering numerous benefits to investors.

Diversification is a key benefit – commercial real estate offers a unique risk profile that can help mitigate volatility in other investments, such as stocks and bonds. You can also invest across various sectors, such as office, retail, or industrial, each with different risks and returns.

Commercial properties often have longer lease agreements than residential properties, providing a more stable and predictable income stream. This can be particularly appealing for investors seeking regular cash flow. He also points out the potential for appreciation – over time, commercial properties can appreciate in value, which can significantly enhance one’s net worth. There are also tax benefits for CRE investors.

Commercial leases often include rent escalations tied to inflation, which means the income from these properties can keep pace with the rising cost of living, protecting your purchasing power.

To get started, you’ll need to conduct market research and financial analysis, establish funding options, conduct due diligence, and seek professional advice.

“You’ll need to consider risks such as market fluctuations, property management obligations, and liquidity requirements,” says Rich.

In conclusion, he believes investing in commercial property can be a powerful way to grow wealth, provided you conduct thorough research, understand the risks, and manage your investments wisely.

Philip Hunt

Philip Hunt, the company’s commercial and industrial consultant in Tauranga’s fast-growing Tauriko industrial area, is adamant that industrial remains the sector’s darling. He says there’s still huge interest from large tenants wanting to be located in Tauriko. However, he has noticed a slowing in their making of commitments due to current economic conditions.

Enquiries remain very strong, as evidenced by the increase in the size of his Tauriko-based team to four. “Businesses are still desperate to locate to Tauriko, particularly now the roading and infrastructure are well in place,” he says.

He notes that stock levels are good, so there are options available for businesses, big or small. But he warns that the days of large annual rent increases are gone for the moment. His advice to landlords now: “Love your tenants and look after them. Wise landlords are doing all they can to retain their tenants,” he suggests.

Philip’s team estimates that well over 50% of their business activity at Tauriko is directly or indirectly Port-related. He continues to praise the Port of Tauranga for its foresight.

Ian Morgan

According to Property Brokers’ Ian Morgan, the agricultural sector is experiencing a notable decline in quality produce worldwide, making it an attractive proposition for investors. However, experts caution that rural property investment is a long-term endeavour.

“It is always about timing, and presently, the agri sector looks very attractive with quality produce diminishing globally. But rural is a long game, and the investor needs to be clear about this.”

However, investors must be aware of the immediate challenges associated with rural investments. In addition to weather-related challenges, market volatility and fluctuating commodity prices add another layer of complexity to the investment landscape. Looking beyond the immediate hurdles, the agri sector is poised for substantial future growth. “Opportunities will be plenty, and the agri sector is well poised to deliver results in the future,” he affirms.

Ian advises investors to adopt strategic approaches, such as spreading investments across various crops and regions, embracing sustainable farming practices and leveraging advances in agricultural technology.

With the right timing and a focus on sustainability and innovation, rural investments can yield significant long-term benefits. For investors ready to embrace the long game, the rural property market offers a promising horizon filled with potential growth and profitability.

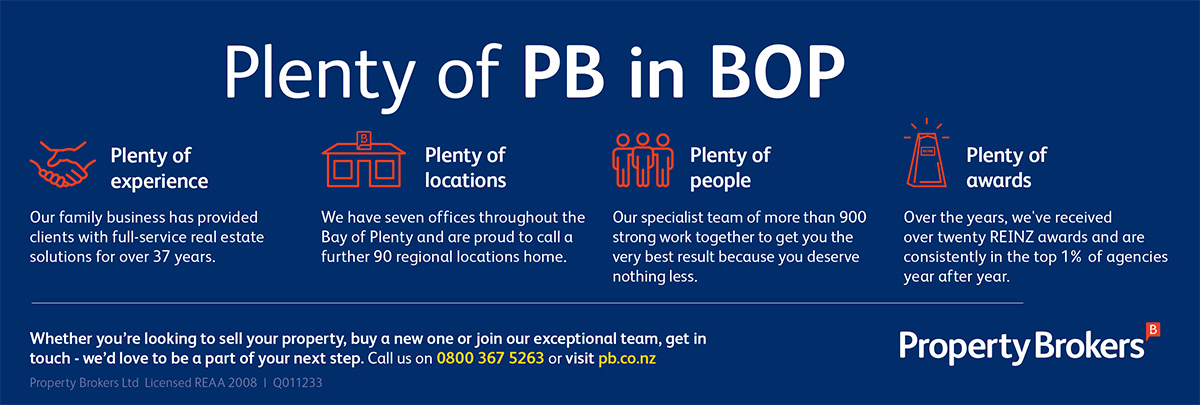

Property Brokers has a wealth of specialist knowledge and offers full-service real estate across residential, commercial/industrial/rural and property management.