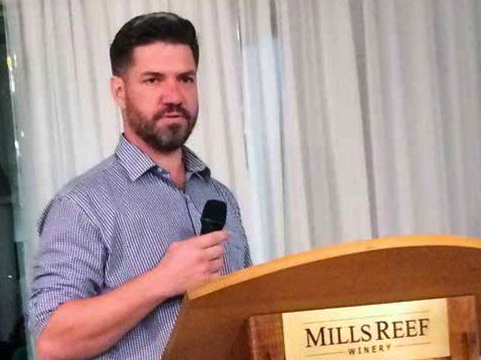

Kiwibank chief economist Jarrod Kerr made a strong case during a recent presentation in Tauranga for the government to take advantage of historically low interest rates to invest in badly needed infrastructure development.

Addressing a large crowd at Mills Reef, Kerr took the audience on a fascinating tour of recent and historic economic and interest rate trends.

In particular, he underlined his view that the recent budget had not done enough to bed in higher levels of GDP growth, and that the government was wrong to stick to its position of fiscal responsibility.

“The point I’ve been making for a year and half is that we need more growth and that growth needs to come from infrastructure – that’s economics 101,” he said.

“For some reason Wellington doesn’t get it. What the [latest]budget showed us is we have had some good growth, the government’s coffers have filled up, but now growth has come off. “

Currently estimates were for annual GDP growth of around 2.75 percent. But given inflation remained low, the country really needed to grow at three percent and above, he said.

It was likely that the government would spend more in the coming year to raise the rate of growth, he suggested.

Kiwibank, the Treasury and Reserve Bank predictions all tended to agree that there would be a lift in growth, largely off fiscal spending, in the run-up to the next election, he said.

“Are we going into an election with this? I think we’ll see more spending coming through.”

The point I’ve been making for a year and half is that we need more growth and that growth needs to come from infrastructure – that’s economics 101.”

– Jarrod Kerr

Kerr noted that there had been little inflation pressure for the past seven years and the new Reserve Bank of NZ governor [to come]was likely to cut the cash rate again to ty and get the inflation rate up to around two percent, he said.

The government wanted to keept net debt as a percentage of GDP down to 20 percent, he said.

“We are already there, why keep it there? Why are we fighting tooth and nail to take growth away from an economy when we really haven’t heated it up because of the fiscal responsibility rules?”

Kerr stated that it had never been cheaper to borrow money cheaply and long term, adding that to do so would have no impact on international agencies such as Moody’s and S&P NZ debt ratings.

During a post-budget meeting with the leading debt rating agencies, Kerr said he had been told by them that NZ had plenty of have plenty of room to move, and had less debt than most countries.

“It’s a really good starting point, because we’ve done a really good job in the past,” he said.

“In my opinion we could have gone to 30 percent – it would have had no effect on our debt rating and we would have built more infrastructure.”

NZ desperately needed a productivity surge, he said.

“In my opinion we can increase this [debt level]quite substantially.

“Interest rates are at the lowest level in history, it will be easy to pay back and the end result will be that we can start building roads and rail, and develop the regions and hospitals etc over five to 10 years and have a much more productive economy.”

Globally there was around US$10 trillion sitting with institutions on negative interest rates, he noted.

“We have access to billions of dollars at very low interest rates.”

“We need to get politicians to realize that we have an untapped source that can be used to build the economy to another level. Whether it’s going to be an easy path is debatable, but we are sitting here with a 20 percent debt target that is leaving us not looking at five-to-10 year projects that we have ample financing for.