Tauranga’s central business district closed out 2018 undergoing the biggest revitalisation in the city’s history.

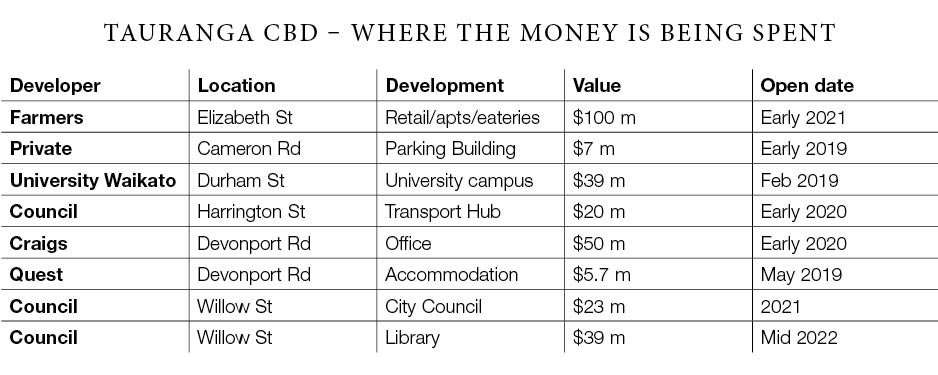

More than a quarter of a billion dollars of investment spend is being injected into buildings and projects across a 20 ha area.

Several big ticket items that have captured headlines in the past year include the University of Waikato campus development, priced at $39 million and due to open a year ahead of time in February.

Several big ticket items that have captured headlines in the past year include the University of Waikato campus development, priced at $39 million and due to open a year ahead of time in February.

Craig’s House on Devonport Road is a $50 million project due to kick off in the New Year, while at the other end of the CBD the Farmers development, valued at $100 million, is now well underway, with a retail completion date of early 2021.

The investment is proving significant, not only on grounds of its scale as one of the country’s most intensely redeveloped areas, but also for the interest it is attracting from investors beyond Tauranga’s boundaries.

Dylan Barrett, a property valuer and director of Preston Rowe Paterson in Tauranga, told Bay of Plenty Business News the city was starting to develop clear CBD precincts that were capturing the interest of larger investors drawn by the prospects of the city’s future growth.

Auckland-based property investment and management group MAAT Group recently purchased 306 Cameron Road. Meanwhile, southerners have also shown an interest with Queenstown-based Maori Hill Property stepping into Tauranga with a company entity investing in the Trustpower building, along with land out at Tauriko.

Barrett said that while the university and Farmers were sound cornerstone investments in the CBD, Trustpower’s move back into the city had helped turn the tide back from the past gradual creep outside of the CBD.

“The larger investment companies have been securing a large amount of A grade assets, showing real confidence in Tauranga.”

University campus impact

The development of the University of Waikato in such a central city site has the university continuing to secure land in the area as part of its 2040 strategy to develop a full campus facility.

There has also been market speculation about the likelihood of a student accommodation facility for the campus being likely to go ahead.

The development of a Quest apartment complex on Devonport Rd is a further $5.7 million investment, due to open May 2019.

Plans for a $40 million hostel on Durham Street were shelved earlier this year, but an alternative in a five storey living facility on Selwyn Street continues to go through resource consent processes.

The recent sale of a large redevelopment site along Cameron Road sold at a premium price of $2730/square sqm (effective), with no development plans yet laid out.

The new developments are also likely to impact upon commercial rental values in the city.

Barrett said superior quality A grade offices generally reflected rentals of “early” $300/square metre.

The current rental rates made it difficult to stack up new office developments when you take into consideration current land values as well escalating construction costs, he said.

“To get an appropriate return, those rental values need to be in excess of $350/square metre. Either land values or construction costs need to adjust, or rentals have to increase to make office development in the CBD feasible.”

Barrett said he also believed central city retail will have a catch-up as pedestrian counts lift with the new projects’ completion.

He noted that retail remains disconnected to some extent from the positive commercial prospects, but says some businesses have recognised the potential more students in the central city bring.

“So we have seen the likes of the Barrel Room and CBK open and it’s likely we will see more service-based companies relocate back into the CBD in coming years to boost this.”

No shortage of investors

Bayleys commercial agent Mark Walton said there was no shortage of investors seeking opportunities within Tauranga’s CBD.

“There are many inquiries from people who have sold off other assets, maybe a house in Auckland or a kiwifruit orchard, who are drawn to the good returns they can get on commercial property.”

Walton said that, in the absence of finance companies that used to command high interest rates for investors, commercial property was a good alternative.

“Compared with the past they are also investing without a significant level of debt being involved.”

Syndicated property groups are also more active, and the entry level for deposits has fallen, making them more accessible to a broader range of investors.

He agreed with Dylan Barrett that there would need to be some adjustments around new property rental values, given the costs of land, demolition and construction on new builds.

“And there are really only so many tenants that can pay the money needed on those spaces.”